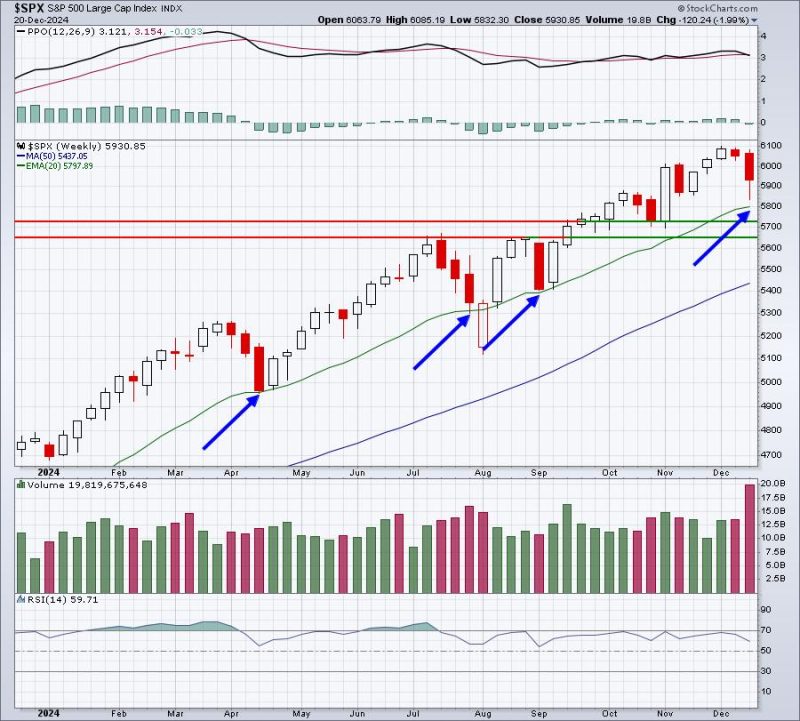

I had no idea the Fed could be such expert wafflers. But, as each month passes, it’s becoming clearer. The overall stock market trend, despite all the back-and-forth, yo-yo Fed decisions over the past 6 months, remains to the upside. Need proof? Check out this weekly S&P 500 chart for the past year:

Now, if you weren’t aware of any news, would you think any differently about this pullback to the 20-week EMA than prior tests to the same level? There was a volume spike, but keep in mind it was December monthly options expiration week. Quad-witching months (March, June, September, and December) typically are accompanied by heavier volume. The Friday market recovery occurred before any significant breakdown on this chart, which I find bullish. I view the stock market action from December 21st through December 31st to be the period where we normally see a “Santa Claus rally” – more on that below.

The Fed has made it clear in the past that they’ve been “data-dependent.” In the latest FOMC policy decision and subsequent press conference, however, Fed Chief Powell indicated that they’ve cut the number of anticipated rate cuts in 2025 from 4 to 2, because committee members feel that core inflation could be higher than they previously thought back in September, when the first rate cut was announced.

Here’s a problem I have, though. On Thursday, November 14th, the Associated Press reported the following:

The Fed acknowledged in this article that inflation remained persistent and above the Fed’s target 2% level. That day, Powell suggested that inflation may remain stuck somewhat above the Fed’s target level in coming months. But he reiterated that inflation should eventually decline. Given those November 14th remarks, if the Fed was concerned about inflation remaining elevated, then why not change their tune on 2025 interest rate cuts at the November 6-7 Fed meeting. If they’re truly “data dependent”, then what data changed from November 14th until the next Fed meeting on December 17-18 to prompt 2025 interest rate policy change?

Can I have a waffle, please?

Odds of a Santa Claus Rally

Again, I consider the Santa Claus rally to be from December 21st through December 31st, so let’s look at how many times this period has actually moved higher:

- S&P 500: 58 of the last 74 years since 1950 (annualized return: +40.50%)

- NASDAQ: 43 of the last 53 years since 1971 (annualized return: +61.80%)

- Russell 2000: 31 of the last 37 years since 1987 (annualized return: +64.57%)

Based upon history, the odds of a Santa Claus rally is 78.4%, 81.1%, and 83.8% on the S&P 500, NASDAQ, and Russell 2000, respectively. And you can see the annualized return for this period in the parenthesis above. I’d say there’s a ton of historical performance to suggest the odds that we’ll rally from here until year end are rather strong.

Nothing is ever a guarantee, however.

Max Pain

In my opinion, the media is promoting the idea that inflation is re-igniting and that the Fed is becoming more hawkish. I believe last week’s selling is due to EXACTLY what I talked about with our EarningsBeats.com members during our December Max Pain event on Tuesday. There was a TON of net in-the-money call premium and the big Wall Street firms aided their market-making units by telling us how bad the Fed’s actions and words are for the stock market. That Wednesday drop saved market makers an absolute FORTUNE. We pointed out to our members the downside market risk that existed, because of max pain. A day later, VOILA! It’s magic! The crazy afternoon selling was panicked selling at its finest, with the Volatility Index (VIX) soaring an astounding 74% in 2 hours! On Thursday and Friday, the VIX retreated back into the 18s (from 28) as if nothing ever happened.

There’s a reason why I preach every single month about options expiration and this was just another example of legalized thievery by the market makers. Let’s give them another golf clap.

MarketVision 2025

It’s almost time for my 2025 forecast, which will be a big part of our Saturday, January 4, 2025, 10:00am ET event. This year’s MV event, “The Year of Diverging Returns”, will feature myself and David Keller, President and Chief Strategist, Sierra Alpha Research. Many of you know Dave from StockCharts and also from his Market Misbehavior podcast. I’m looking forward to having Dave join me as we dissect what we believe is likely to transpire in 2025. For more information on the event and to register, CLICK HERE!

Happy holidays and I hope to see you there!

Tom